nh business tax calculator

For multi-state businesses income is apportioned using a weighted sales factor of two and the standard payroll. New Hampshire has a 0 statewide sales tax rate.

Missouri Income Tax Rate And Brackets H R Block

Cashier po box 2058 concord nh 03302-2058 phone.

. The RD tax credit. Any business changescorrections should be made on the employer change notice nh employment security attn. The current BPT rate in.

The assessed value multiplied by the real estate tax rate equals the real estate tax. Welcome to the State of New Hampshire Child Support Calculator. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Automate sales tax calculations reporting and filing today to save time and reduce errors. New Hampshire Gas Tax.

Compare this to income taxation for this person at 5235 without deductions taken. Enter your property assessment in the field below. Start a trial Contact sales.

Use our interactive calculator below to gain a better understanding of how your business can maximize its support of local community projects through the CDFA Tax Credit Program. Please note savings and net cost are based on an individual business federal and state tax rate. 603 224-3311 wwwnhesnhgov employer quarterly tax report 1st month 2nd month 3rd month make check payable to.

State employer number 3. While its not a fun number to calculate your portion of the transfer tax will be accounted for on your closing disclosure when you receive your final numbers. The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to.

The 2021 tax rate is 1503 per thousand dollars of valuation. NH Department Of Labor. This is the 24th-highest cigarette tax in the US.

Our small business tax calculator is very accurate. Actual savings and net cost will vary. The printsave button will be available once the initial calculations have been completed.

As of December 2018 the state of New Hampshire reduced the tax rates for two types of tax. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. New Hampshire Business Profit Tax Rate Reductions.

It is recommended that you start by reviewing and completing all income and expense related links before moving on to. In NH transfer tax is split in half by buyer and seller. Youre guaranteed only one deduction here effectively making your Self-Employment tax 1413 or 7065.

That tax applies to both regular and diesel fuel. One thing youll notice on your New Hampshire paycheck is deductions for FICA Federal Insurance Contributions Act taxes. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends.

Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C. New Hampshires income tax is pretty simple with a flat rate of 5 and no local income taxes. New Hampshire Personal Income Tax.

Businesses the gross less than 50000 are not required to file for business profits tax. Please be sure to review the completed form before saving or printing it. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

New Hampshire Unemployment Insurance. New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. The current real estate tax rate for the City of Franklin NH is 2321 per 1000 of your propertys assessed value.

Meals Rentals Tax. This tax is not paid directly by the consumer. Our small business tax calculator does not account for certain tax credits that your company may be eligible for eg.

Additional details on opening forms can be found here. New Hampshire Business Profits Tax BPT If you operate a business within the state of New Hampshire youll have to pay taxes on any profits that you make. As an employer youre responsible for paying unemployment insurance.

You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code. New Hampshires excise tax on cigarettes totals 178 per pack of 20. State of nh - uc 1.

Estimate of Property Tax Owed. Fillable PDF Document Number. The business will also owe New Hampshire business enterprise tax in the amount of 1100 055 of 200000.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Hampshire local counties cities and special taxation districts. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. New Hampshire Cigarette Tax.

The 2020 tax rate is 1470 per thousand dollars of valuation. Start managing your sales tax today. Name of Average wage.

FICA taxes are Social Security and Medicare taxes and they are withheld from each of your paychecks in order for you to pay into these systems. Real Estate Tax Rate. Take the purchase price of the property and multiply by 15.

These tax credits can have a very large impact on your tax calculation. The New Hampshire bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. This tax is only paid on income from these sources that is 2400 or more for single filers and 4800 or greater for joint filers.

The 2019 tax rate is 1486 per thousand dollars of valuation. The business will owe New Hampshire business profits tax in the amount of 38000 76 of 500000. The tax is assessed on income from conducting business activity within the state at the rate of 77 for taxable periods ending on or after December 31 2019.

Employer name address 2. Ultimately it depends on the accuracy of the selections and inputs that you make. New Hampshire Sales Tax Calculator.

Tax Obligations Business Licenses Permits. Concord City Hall 41 Green Street Concord NH 03301 Phone. The Business Profits Tax BPT was enacted in 1970.

Divide the total transfer tax by two. Social Security is taxed at 62 and Medicare at 145. The New Hampshire Business Profits Tax BPT rate went from 82 to 79 and the New Hampshire Business Enterprise Tax BET rate dropped from 072 to 0675.

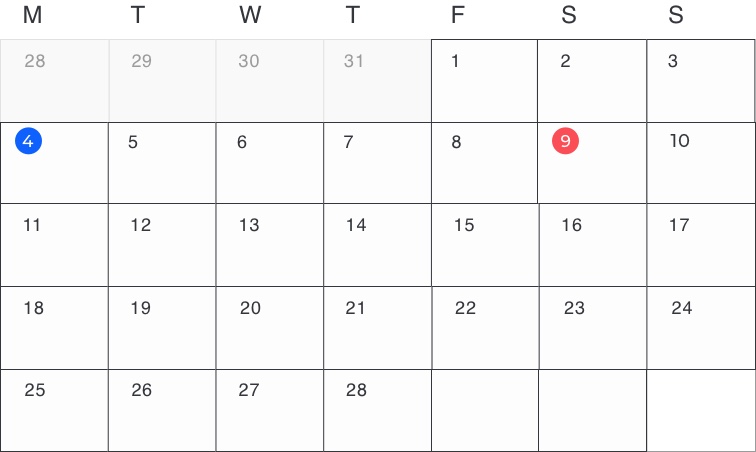

For the 2022 tax year your sole proprietorship had New Hampshire income of 500000 and an enterprise value tax base of 200000. 1 27 2 28 3 29 4 30 5 31 6 32 7. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

The gas tax in New Hampshire is equal to 2220 cents per gallon.

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

Income Tax Calculator Estimate Your Refund In Seconds For Free

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Tax Calculator Definitive Small Business Tax Estimator

New Hampshire Income Tax Calculator Smartasset

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Timber Basis Decision Model A Calculator To Aid In Federal Timber Tax Related Decisions Extension

Business Tax Data Nh Department Of Revenue Administration

Income Tax Calculator 2021 2022 Estimate Return Refund

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

How To Calculate Sales Tax Definition Formula Example

Business Nh Magazine Nh Named A Most Tax Friendly State

New Hampshire Paycheck Calculator Smartasset

New Hampshire Income Tax Calculator Smartasset